What Is The 179 Deduction For 2024. Key takeaways qualifying vehicles must be. How to incorporate section 179 into your business.

A beginner’s guide to section 179 deductions. How to incorporate section 179 into your business.

For The Tax Year 2024, The Dollar Limit Or The Maximum Amount That You Can Deduct Using The Section 179 Deduction Is At $1,220,000 ($1,160,000 For Tax Year 2023).

Once a business has bought assets valued in.

For 2024, The Section 179 Expense Deduction Is Capped At $1,050,000, And The Total Amount Of Equipment Purchased Cannot Exceed $2,620,000.

Also, to qualify for the section 179 deduction, the equipment and/or software purchased or financed must be placed into service between january 1, 2024 and december 31, 2024.

What Is The Maximum Limit For Section 179 Deduction In 2024?

Images References :

Source: www.joerizzalincolnoforlandpark.com

Source: www.joerizzalincolnoforlandpark.com

Lincoln Vehicles that Qualify for Section 179 Deduction, Section 179 limits 2022 vs. In 2024, the section 179 deduction limit has been raised to $1,220,000 (an increase of $60,000 from 2023).

Source: www.zrivo.com

Source: www.zrivo.com

Section 179 Tax Deduction 2023 2024, Section 179 of the irc allows businesses to take an immediate deduction for business expenses related to depreciable assets such as equipment, vehicles, and software. Once a business has bought assets valued in.

Source: www.taxuni.com

Source: www.taxuni.com

Section 179 Deduction 2023 2024, Section 179 of the irc allows businesses to take an immediate deduction for business expenses related to depreciable assets such as equipment, vehicles, and software. In 2024, the section 179 deduction limit has been raised to $1,220,000 (an increase of $60,000 from 2023).

Source: ecomachinetools.com

Source: ecomachinetools.com

2024 Section 179 Deduction Limit Max Section 179 Deduction 2024, This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,890,000. For 2024, the maximum 15.3% se tax rate will apply to the first $166,800 of net se income (up from $160,200 for 2023).

Source: www.commercialcreditgroup.com

Source: www.commercialcreditgroup.com

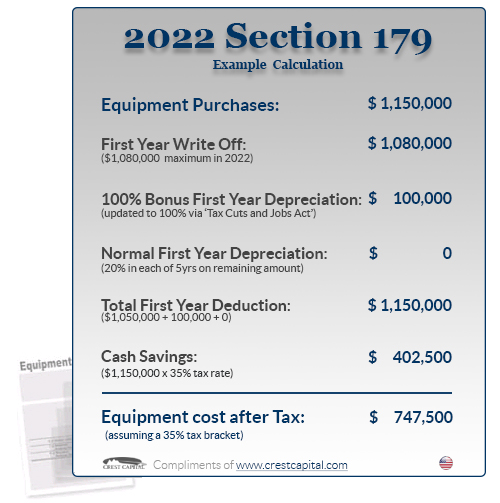

Section 179 & Bonus Depreciation Saving w/ Business Tax Deductions, The total available deduction increased from $1,080,000 to $1,160,000, meaning you can deduct up to that amount on your taxes. Key takeaways qualifying vehicles must be.

Source: ccckc.com

Source: ccckc.com

Section 179 Deduction and How it Can Help Your Company Save Money and, Claiming section 179 depreciation expense on the company’s federal tax return reduces the true cost of the purchase to $130,000 (assuming a 35% tax bracket),. Make sure your asset is eligible.

Source: www.michiganbuilderslicense.com

Source: www.michiganbuilderslicense.com

2023 Tax Savings Section 179 Deduction for Michigan Builders Blog, Once a business has bought assets valued in. Under the 2024 version of section 179, the deduction threshold in terms of the value of new equipment purchases is $3,050,000.

Source: www.pittsvilleford.com

Source: www.pittsvilleford.com

Section 179 Tax Deduction Pittsville Ford Pittsville, MD, For 2024, the maximum 15.3% se tax rate will apply to the first $166,800 of net se income (up from $160,200 for 2023). Section 179 deduction dollar limits.

Source: taxsaversonline.com

Source: taxsaversonline.com

Understanding IRS Section 179 Deduction (Ultimate Guide), For 2024, the section 179 expense deduction is capped at $1,050,000, and the total amount of equipment purchased cannot exceed $2,620,000. For tax years beginning in 2023, the maximum section 179 expense deduction is $1,160,000.

Source: www.deskera.com

Source: www.deskera.com

Understanding Section 179 Deduction in the US, Irs section 179 covers business deductions for equipment. Key takeaways qualifying vehicles must be.

In 2024, The Section 179 Deduction Limit For.

Section 179 of the irc allows businesses to take an immediate deduction for business expenses related to depreciable assets such as equipment, vehicles, and software.

The Total Available Deduction Increased From $1,080,000 To $1,160,000, Meaning You Can Deduct Up To That Amount On Your Taxes.

For the tax year 2024, the dollar limit or the maximum amount that you can deduct using the section 179 deduction is at $1,220,000 ($1,160,000 for tax year 2023).