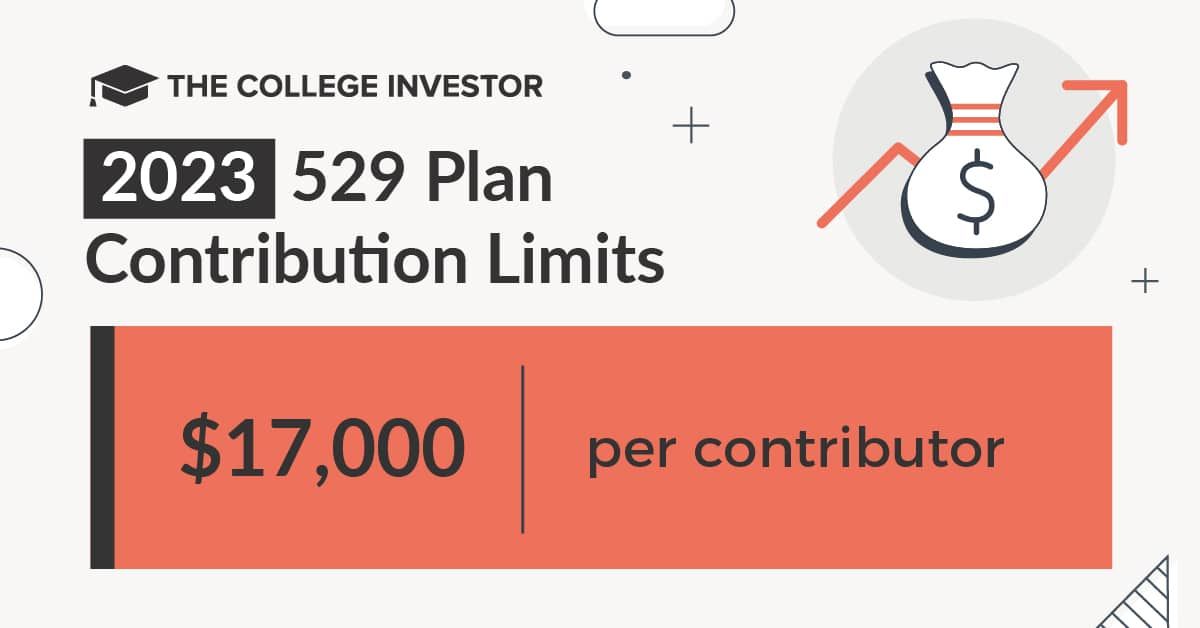

529 Plan Contribution Limits 2024 Florida. Florida 529 plans have a high. The maximum contribution limit pertains to each beneficiary.

The change takes effect in january 2024, and the account must have been open for 15 years (with rollover funds in the account for at least 5 years). Florida prepaid and florida 529 savings plans work well together.

529 Plan Contribution Limits 2024 Florida Images References :

Source: casibjennee.pages.dev

Source: casibjennee.pages.dev

529 Plan Contribution Limits 2024 Florida Lanna Mirilla, As of january 1, 2024, when you discover you have extra money in your child’s 529 plan, there is a fourth option to select from.

Source: denyseypearla.pages.dev

Source: denyseypearla.pages.dev

529 Plan Contribution Limits 2024 Pdf Download Natty Viviana, Florida 529 plans have a high.

Source: blinniqjillana.pages.dev

Source: blinniqjillana.pages.dev

529 Plan Contribution Limits 2024 Joan Ronica, 529 plan aggregate contribution limits by state.

Source: nexnews.org

Source: nexnews.org

529 Plan Contribution Limits For 2024 Nex News Network, 401 (k) plans and individual retirement accounts (iras).

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg) Source: perlaqjacquette.pages.dev

Source: perlaqjacquette.pages.dev

529 Plan 2024 Contribution Limits Dana Milena, In september 2019 the board enhanced the plan with expanded investment options,.

Source: kitblatashia.pages.dev

Source: kitblatashia.pages.dev

529 Plan Contribution Limits 2024 Married Filing Jointly Kaye Savina, Since each donor can contribute up to $18,000 per beneficiary, a married couple can.

Source: arielqgianina.pages.dev

Source: arielqgianina.pages.dev

529 Annual Contribution Limits 2024 Dianne Kerrie, Contributions to a 529 plan are generally considered completed gifts to the student and may be contributed, up to federal gift tax limits, to a plan without being subject to federal.

Source: lesyaqmichaela.pages.dev

Source: lesyaqmichaela.pages.dev

529 Limits 2024 Elset Horatia, Since each donor can contribute up to $18,000 per beneficiary, a married couple can.

Source: ardythylonnie.pages.dev

Source: ardythylonnie.pages.dev

529 Plan Maximum Contribution 2024 Pdf Download Pearl Brittany, The change takes effect in january 2024, and the account must have been open for 15 years (with rollover funds in the account for at least 5 years).

Source: kimberlynwalvera.pages.dev

Source: kimberlynwalvera.pages.dev

Irs 529 Contribution Limits 2024 Rory Walliw, The maximum contribution limit pertains to each beneficiary.

Category: 2024